Hello together,

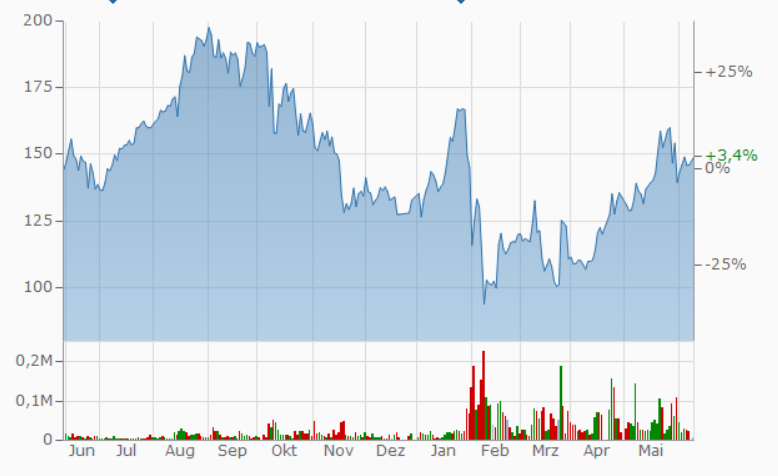

At the end of January I put a few Wirecard shares in my wikifolio for 162 €.

Shortly thereafter, the crash followed to under 100 €.

While I was trying to analyse my mistakes, I vowed to stay calm and wait.

Four months later, let's take a look at the chronicle of my at first glance catastrophic plant.

01/30/2019 15:29: I buy Wirecard at a cost price of €162.09. Cheap, I think.

01.02.2019: There is a negative press report. Wirecard rushes down to just under €100 at the top and closes at just under €115.

Loss: – 30%

04.02.2019: There is slight hope. I am buying at the price of 128,500 €.

My cost price is thus approx. €145.

08.02.2019: Once again, there is negative news. The stock is down to €86. Many stop orders are thought to have been around €100.

Loss at this time: -40%

18.02.2019: BaFin bans short selling on Wirecard shares, and the price is slowly starting to stabilize.

Loss: -20%

March 2019: The stock market price swings between 120€ and 100€. On 25.03. the low is again 95€.

Loss: -35%

April 2019: The price stabilizes and climbs back to €133 by the end of the month.

Loss: -8%

March 2019: In the meantime, the price climbs again to 160€.

Win: 10%

June 2019: I decide to sell half of my Wirecard position at the price of €149.

Realized profit: 4.5%

Conclusion

While in my view I have not acted particularly well or particularly badly in this case could be avoided by staying calm a loss of 20% of the capital.

Personally, I think it is quite realistic that Wirecard will soon be aiming for the €200 again. But I wouldn't bet on it.

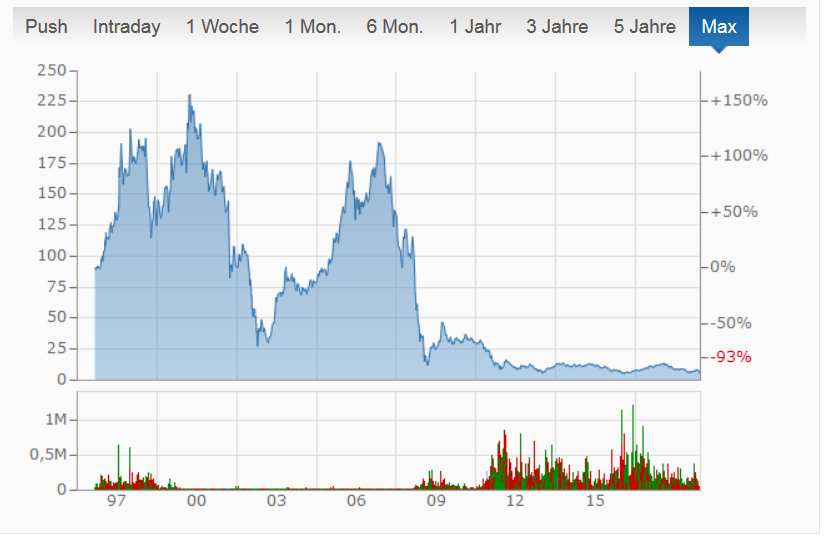

The examples of Deutsche Bank and Commerzbank show that staying calm does not always automatically end with a profit. But here, too, one could have saved a part of the capital by selling in time after a price recovery.

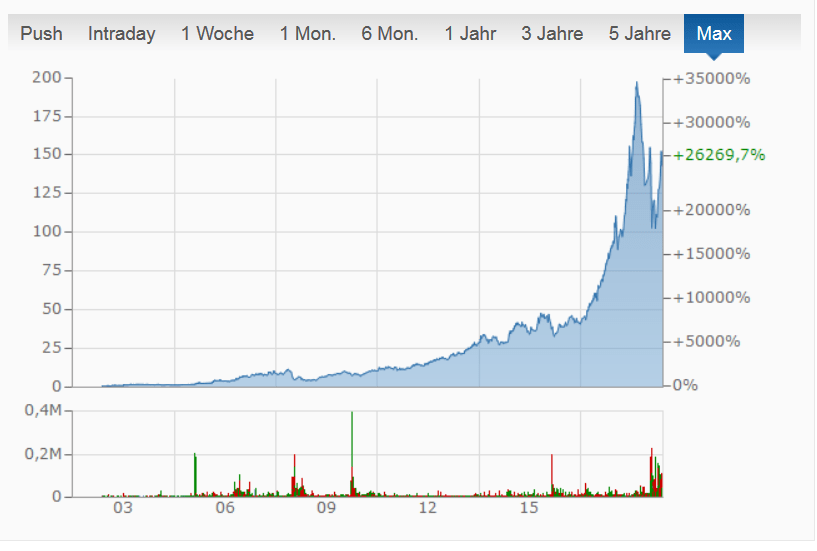

The advantage of Buy&Hold

In 20 years, however, the "Wirecard Crash" is a "fly shot"

Or does anyone see in the chart above that the Wirecard share lost more than 60% of its value in a month in 2008?

Or does anyone see in the chart above that the Wirecard share lost more than 60% of its value in a month in 2008?

From 10 € in June to 4 € in July ?

If you want to spare your heart, you rely on Buy&Hold. You can't lose more than the money there, and historically you would have made a lot of profit.

How did your Wirecard trade go? Are you still holding or have you sold?