Hello together,

the financial transaction tax is currently on everyone's notice, especially in Germany, after Olaf Scholz proudly announced via Twitter an alleged breakthrough with 10 other European states.

Beautiful birthday present after long night of negotiations: Important progress for #Europa: 1. #ESM reform for more stability 2. Decisive step in the #Eurozonenbudget. 3. This year, the basis for the survey of #Finanztransaktionsteuer will come from 2021. #EU pic.twitter.com/ellE6Maa4w

— Olaf Scholz (@OlafScholz) 14. June 2019

However, it is not possible to speak of a financial transaction tax, as only the purchase of shares according to the French model is to be taxed effectively.

What does that mean?

The French model

If the Finance Minister prevails in the future (presumption: 2021), the following changes will be made for German and German European stock values:

- The acquisition of German shares with a market capitalisation of more than 1 billion € is subject to a tax (currently in France in the amount of 0.3%)

- Taxation takes place independently of the place of the transaction, so German shares are also more expensive on foreign stock exchanges

- Only shares on the regulated market are recorded

- Daytraders and high-frequency trading are in principle excluded.

- Option traders and other derivatives are also spared.

What I think of it

- As anyone who understands a little bit of the matter can think, this tax will not improve the stability in the financial markets a bit

- What causes stock market crashes? Correct: Sales. So why punish the buyers who bring stability?

- The equity and, indirect, ETF and fund savers are primarily asked to pay.

The terms "share penalty tax" or "wealth build-up tax" are, in my view, much more accurate.

What will it cost you as a Buy&Hold investor: Possible scenarios?

I have looked at different scenarios for this. First of all, the following key data:

- Monthly investment amount: 500€

- Dynamics of the investment sum: 5% p.a.

- Annual price increase: 6.5% (the EuroStoxx average from 1986 to the present day)

- Duration: 20 years

Scenario 1: Excluding share tax (only the normal tax of 26.375% is due)

Scenario 2: With a share penalty tax of 0.1% per purchase

Scenario 3: With a share penalty tax of 0.3% per purchase

Scenario 4: With a share penalty tax of 0.3% per purchase, however, the soli of 1.375% is eliminated.

For the calculation I used the well-known fund savings plan calculator.

Result

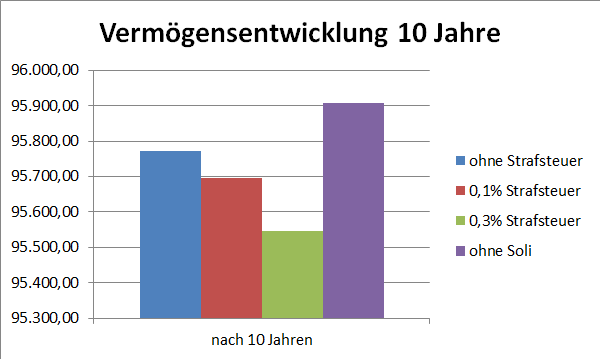

Let's look at the costs after 10 years:

After 10 years, the worst case is €226 in financial transaction taxes. The relief from the elimination of the solidarity surcharge on investments would amount to €360 in spite of the financial transaction tax over the same period.

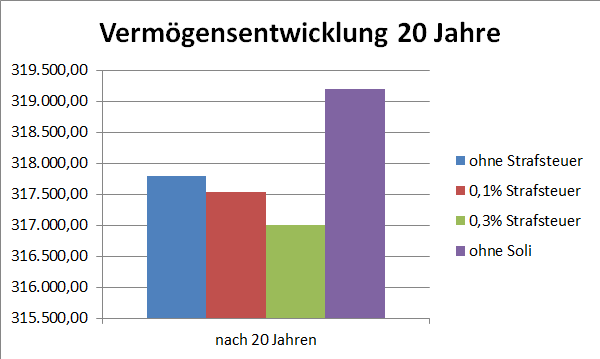

After 20 years, a similar picture emerges:

Here, the amount of the penalty tax is a net 600 €. That is still only 0.2% of assets after tax or, in other words, the change from Amundi to the Vanguard ETF.

If the solo falls away, you still save 2200€.

So everything is good. Thank you Olaf Scholz ?

No. If the level of the transaction tax remains at the forecast 0.3%, the financial transaction tax is likely to be negligible for most buy&hold investors. but:

- Firstly, these are just speculations. The exact level of the financial transaction tax is no more known than the precise parameters for abolishing the solidarity surcharge.

- An increase in the financial transaction tax or other sources of money to saver is not excluded over a period of 10 or even 20 years and is likely.

- While the market value of your investment may fluctuate and lead to a total loss, the tax already paid for the purchase is most likely gone.

- The financial transaction tax completely misses its purpose. This starts with the taxation of the purchase (can Olaf Scholz explain the stock exchange ?).

What to do?

Contact @OlafScholz via Twitter, alternatively you can also contact your local SPD district office.

Or make mobile on social networks or share this post. The introduction of the tax will probably no longer be prevented, but the SPD should get some headwinds from the small savers (Hello SPD, this is also your clientele).

You can't imagine it, but even the nasty buy-and-hold investor has an interest in stable stock markets.

Unfortunately, this tax will have no effect in this direction.

Perhaps the SPD should also turn on the scientific service of the Bundestag next time before selling something like this as a success.

Hopefully we can achieve something together. Until next time.