— Dear English speaking visitor, English is not my native language and as a poor finance blogger I can’t afford translating it professionally, so please if the translation is crap just leave me a comment on how to make it better. For now this is just an experiment so you won’t find a lot of english posts here and also the images will remain in german.

Machine translation is available here.

Now enjoy your stay. Thank you —

Hello together,

As you probably already know, Finance Minister Scholz is planning a share tax under the striking title: “Financial Transaction Tax”.

That this only meets the small stock saver and not the speculator is often swept under the table, but I already described it here in the blog a few months ago. This reduced tax is now expected to bring in between EUR 1.2 and 3.9 billion per year instead of the originally planned eur 34 billion.

How does this difference of a factor of 10 actually come about? I wondered how much the revenue of a “real” financial transaction tax could be if it were not only passed on to private equity savers, but also other securities and speculators.

The results speak for themselves.

Olaf Scholz Presentation of fair taxation

The financial transaction tax is expected to be between 0.1 and 0.3 percent and will be charged for each turnover of a share with a company with a market capitalization of more than €1 billion. Daytraders, high-frequency trading and all derivatives are excluded in addition to bonds. The main thing, then, is private investors.

ETFs, funds and other stock-based products (e.g. unit-linked life insurance) will certainly pass on the costs to the customer.

But equities are also the biggest item, gambler papers ! If you can get money in somewhere then there. Or?

Not quite!

Turnover through equities – investment for large and small

Let’s just look at the turnover of XETRA and Frankfurt Stock Exchange of the DAX shares only for September 2019, we see the quite high figure of 76,259,117,064.88 € i.e. around 76 billion. €. In 2018, total sales amounted to €1,014,874,811,929.76, or more than €1 trillion.

In addition, there is the MDAX, whose components are also all over 1 billion. capitalisation in the market. Here came again in September approx. 18 billion I would like to add to that. In the whole of 2018, the total was almost €200 billion.

Let’s take the sale of the other German stock exchanges, other stocks that are not listed in the DAX or MDAX, and the unclear OTC trading of an additional 5 billion sales per month or 60 billion a year, which still comes on top.

The total volume of trade is therefore around €1300 billion per year.

That sounds a lot. And of this, 0.3 percent is *drum swirl* 3.9 billion euros or 1.3 billion euros at a tax rate of 0.1 percent.

Has Olaf Scholz settled on the shares?

So if I haven’t completely billed myself now, Olaf Scholz’s experts may have used the same calculation path as me. However, this would be completely meaningless, as it would have to include the share of players such as day traders, market makers and high-frequency trading, which probably also account for a larger percentage in equity trading.

But perhaps we also assume larger amounts of OTC transactions or the influence of ETFs and funds? Perhaps a reader can help me at this point.

Be that as it may, even if the total share turnover of DAX and MDAX were taxed, only EUR 3.9 billion would be incurred. The state can only pay the federal police for this.

But why tax only shares? With all the certificates, there is still something to be gained.

Turnover through structured securities – gambles for small

It’s going to be exciting here, isn’t it? This category includes warrants, certificates, and so on. The things that private investors gamble with and destabilize the stock markets.

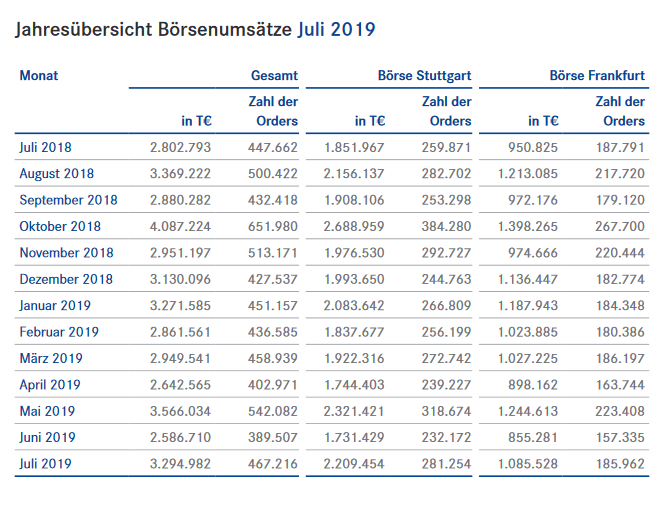

It is interesting to note that the turnover of these derivatives is more transparent than that of bonds. The German Derivatives Association keeps a statistic for the Stock Exchanges Stuttgart and Frankfurt. However, the total amount is sobering, at around EUR 40 billion a year. So there’s not much to pick up here. After all, they are only private investors. The 80 million in taxes from this would hardly be enough for a mediocre professional footballer today.

Did Olaf Scholz even think about bringing all the life insurance companies and banks on board, which mostly rely on bonds ?

Turnover from bonds

The German Financial Agency has calculated that in 2018, federal bonds alone will generate a turnover of 4700 billion euros. € (excluding initial issues). That alone is three and a half times the share turnover !

Since federal bonds are probably by far the biggest item and unfortunately I don’t know the other sales, I suspect i’m just at least 5000 billion. € Total sales.

Of this 0.2%, this amounts to at least €10 billion in potential tax revenues. Significantly more than in the case of shares and more than the federal government spends on parental allowances in the year.

Is there perhaps more to pick up somewhere? We already had derivatives at the top, haven’t they?

Sales through options, futures and other derivatives – Gambles for large

To do this, I took a look at sales at EUREX, one of the largest futures exchanges in the world. One of the interesting things is the product selection. So I can trade futures on ETFs, dividends from individual companies, but also on any currency pair that you can imagine. In addition to the certainly existing hedging strategies, it is a bit reminiscent of British bookmakers, where you can bet on the name of the next royal baby. anyway.

Now comes the real hammer: in August 2019 alone, derivatives amounting to 10,711,542,652,950 were traded there. 10.7 trillion euros. So almost 10 times as much as is converted into stocks in a whole year.

On a yearly scale, the turnover here is between 90 and 100 trillion euros. Again to write: 90000 billion € !

Of this 0.2%, an astonishing EUR 180 billion ! By way of comparison, the Federal Ministry of Labour and Social Affairs has earmarked expenditures of EUR 145 billion for 2019. Pension funds pay out around EUR 300 billion per year.

Admittedly, I have little idea about the tax situation with such derivatives and certainly there are values there again on which one should not levy tax, but let us assume that only 10% of the transactions there would be taxable. already to EUR 18 billion per year.

The state is giving away billions

So the EUR 3.9 billion that Olaf Scholz wants to raise is actually far too little. Because where he wants to get them is unfortunately completely wrong.

Taxation of all types of securities would in fact generate revenue in the three-digit billions ! Depending on the calculation, this would theoretically be possible by EUR 100 – 300 billion.

And even when you think about taxing derivatives, you can even come up with the idea to raise 34 billion euros ! That would be an absolutely unrealistic objective if all other types of securities were to be taxed at the rate that has been circulating up to now.

Conclusion

- The financial transaction tax is charged to one of the weakest securities segments. Bonds and derivatives are traded on a much higher scale. The alleged “transaction tax” is not even levied on one percent of total stock exchange transactions. 99 percent of transactions are not taxed !

- With the financial transaction tax, you only meet private investors. Daytraders, high-frequency trading and institutional investors who mostly trade derivatives remain excluded.

- The estimate of the assumed amount of annual revenues of €3 billion is more than questionable and does not match the turnover on the stock exchanges if day traders and high-frequency trading do not have to pay them.

- The actual speculations with derivatives, e.g. eurEX has a 100-fold increase in sales. If this turnover were taxed at only 0.01% one would take in more than €12 billion a year.

- If only 10% of derivatives were also taxed at 0.2%, EUREX alone would generate revenues of €18 billion a year.

- In theory, the revenue potential in the derivatives sector is in the three-digit billion range

In summary, my criticism is not so much about the amount (which is of little importance to the individual) or the tax itself, but rather of the absolutely wrong direction of steering of this tax. Retail investors are being punished and speculators are allowed to carry on as before.

What to do?

There is a petition from the DSW (with which I have nothing else to do) against the financial transaction tax.

The Nuremberg Stock Exchange Association has also started a petition to this end.

If you also agree with my opinion, I ask you to sign it.

Otherwise, I fear that we are powerless because, unfortunately, the lobby of banks and speculators is much larger and more powerful than that of retail investors.

But if someone walks over you who thinks Olaf Scholz’s share tax is a great idea against big business, please show him this post. Thank you.

[the_ad id=”1996″]

You liked the post ? Recommend it via Facebook or Twitter (privacy-compliant links under this post). Thank you in advance 🙂

Also take a look at my other projects: the charity depot and the self-test warrants.