Hello together,

in this loose series, I would like to take a look with you at current bonds new issues for various bond types. The previous episode can be found here.

If you are looking for basic information about bonds, you should read about part 1 of my bond information. If you are more interested in bond ETFs and the advantages and disadvantages of bonds and equities, this contribution is of relevance to you.

As always, these are not recommendations for the installation. Investments in bonds can end in total loss.

Why Bonds

Bonds have some advantages to equities. First of all, most bonds have a fixed maturity and fixed interest rates. This means that you already know at the beginning of the investment what profit you can expect (if the bond does not fail).

A bond can therefore be an alternative to the savings book or daily money account if everything goes well.

However, the risk for bonds is generally lower than for equities, as there is still a chance that the issuer will be paid out of the debtor's insolvency assets. As a shareholder, you usually run out of steam.

Buy bonds directly instead of scattering assets in bond ETFs

Compared to bond ETFs, one can choose as a private individual special bonds (with sometimes also low issue volume) which a bond ETF is not allowed to buy at all due to this and thus perhaps a higher yield than with the forest and meadows bond ETFs.

In addition, there are no other costs other than the trading costs of direct purchase of a bond.

However, in most other respects (risk, volatility), a bond ETF performs better. In this respect, for me, the only option for direct purchase of a bond would always be to invest in a targeted manner with smaller amounts.

Criteria

The bonds are rated by me on a scale of 0 – 10 according to the following criteria:

Yield – Comparative benchmark here are federal bonds of similar maturity. These receive 0 points due to negative interest rates. If the bond offers more, there is one point per percentage point.

Security – This is in addition to a existing rating, in particular according to the ownership structure and the prospects that the bond will also be repaid

Transparency – there are minus points for convertible bonds, subordinated bonds, adverse termination dates and other adverse provisions.

So maximum is 30 points. The rating is purely subjective and should only give a first indication. Please think about a plant yourself, read the brochures and be aware of the risk.

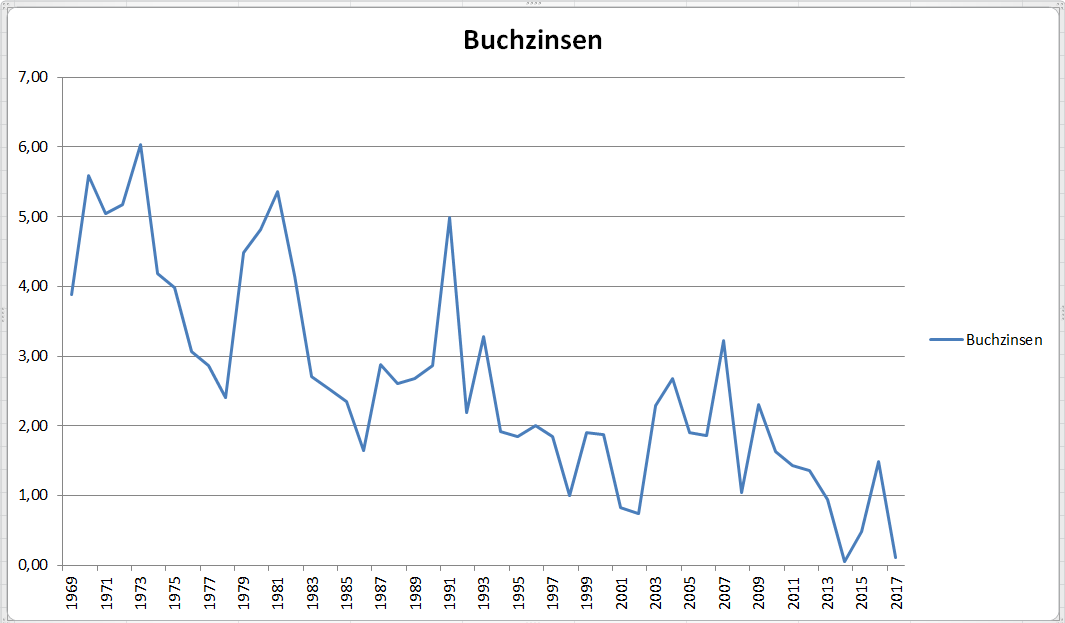

Book interest rates on savings deposits with banks are currently close to 0. It is obvious that some people are looking for alternatives.

Selected bonds new issues in October 2019

Saxony Minerals & Exploration – SME AG Bond Maturity 5.5 Years Coupon 7.75% (DE000A2YN7A3)

Yield: 8 /10

Safety: 2 / 10

Traps: 9 / 10

First, let's take a look at this medium-sized bond from SME AG. This is a Central German mining company. According to the management's prospectus, 700 million people are sitting here in raw materials (primarily tungsten and fluorite) and want to use this bond to finance the development of these very financing. Risky project, no question.

On the other hand, the coupons up to 2024 are 7% – 8% set. There is a termination clause from year 3, but there is additional compensation for investors (104% in year 3, 103% in year 4 and 101% in year 5), so that the return looks very attractive in any case. The target group is private investors and institutional investors.

All in all: 19 / 30 points.

More information can be found here.

Disclaimer: I have received compensation for considering this bond. This did not affect my rating.

Brandenburg Land Bond: 0.300% to 04.10.2049 (DE000A2TR6G5)

Yield: 0.5 / 10

Safety: 8 / 10

Traps: 10 / 10

You want to know today what your money will do for the next 40 years? Then this is your bond.

Excluding interest, the deposit of €10,000 results in an interest income of €1200. Over 40 years.

The state of Brandenburg is unlikely to go bankrupt more than the federal government. There are only deductions for the long term. The return is far from good for this long term, but well. There are no negative pitfalls either.

All in all: 17.5 / 30 points.

Renault bond: 1.125% to 04.10.2027 (FR0013451416)

Yield: 1 / 10

Safety: 5 / 10

Traps: 5 / 10

You want to park your money for 8 years halfway safely, get a measly interest rate and have a termination option in your neck at any time? This Renault bond offers you just that.

Compared to other corporate bonds that offer similarly poor conditions, I chose them because of the relatively high level of security.

Perhaps the only problem is denomination, which is €100,000.

All in all: 11 / 30 points.

[the_ad id=”1996″]

Do you currently have bonds in the depot ? Write me a comment.

You liked the post ? Recommend me via Facebook or Twitter. Thank you in advance 🙂

Also take a look at my other projects: the charity depot and the self-test warrants.