Hello together,

The profits of this website flow through the so-called charity depot. You can find all the information here.

After I was able to make my first donation last time, the balance is sufficient this time to include a new ETF again.

In addition, I list again the income and expenses, which might also be of interest to one or the other blog operator who wants to know what you can earn with such a blog.

After that, we come to the performance of the sustainable depot.

The review begins with all the income received since the last contribution to the Charity Depot.

Revenue

Revenue is available through affiliate links to, for example, fixed-rate offers or brokers such as Onvista Bank.

If you then become a customer I will receive a premium.

There are also advertising banners from Google AdSense, which are usually remunerated per click. An example might appear here:

[the_ad id=”1996″]

Since the last post, however, I have significantly reduced the number of Google ads, because it clearly became too much for me on the page.

I have also decided that profits from the warrant experiment will go to the charity depot.

Even for guest contributions like this, I may receive a payment.

Since June, the charity depot has thus generated the following revenues:

(Transfer: +€160.61)

Revenue commissions (July – September): + €91.50

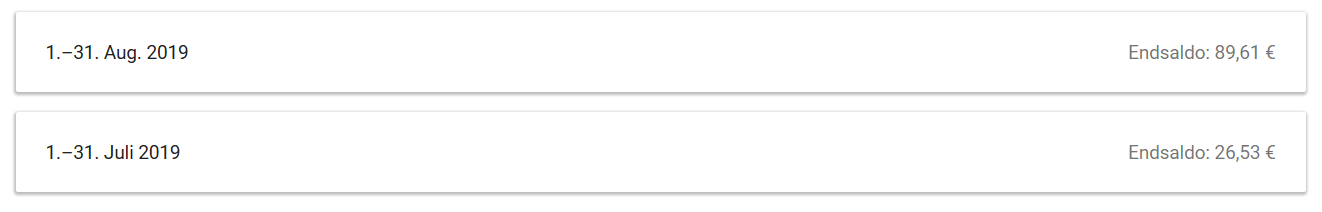

Revenue AdSense (July – September): + €89.61

Revenue option note experiment: + 0.00 €

Revenue Other: + €100.00

The AdSense revenues from July and August. Since I put little online in July and there were also problems with AdSense there was also lower revenues.

Total: €281.11

Expenditure

This time there were the following costs:

- Commercial Office: €25.00

- Webspace Provider: €9.48

Total: €34.48

Profit

Revenue – Expenditure = Profit (before tax)

€281.11 – €34.48 = €246.63

Verdict: This is a new record profit in such a short time. Thanks to the loyal readers of this site, the charity depot is already in the four-digit range this year. Rather than I thought ! Thank you!

Tax notice

The taxes on the profits and also on any profits from the charity depot are in my personal tax return and are borne by me for the time being. Compensation and clearing will take place at the end of the year.

The performance of the Charity Depot

As a benchmark for Charity Depot, I chose the Xtrackers MSCI World Index (IE00BK1PV551) ETF.

Since the MSCI World performed better than the MSCI Europe, the following picture is currently obtained:

Performance Benchmark: +8.6%

Performance Charity Depot: +5.82%

A new purchase: Emerging Markets

Together with the transfer from the previous month, I am available for a new purchase over 400€. So it's high time for a new ETF. The selection is again via the proven coffee method.

sHowever, it was not easy, because I was thinking about investing in a sustainable emerging markets ETF this time. Especially in the emerging markets, the topic of sustainability is a little noticed topic. Investors, however, have a leverage to change this with their investment and to sensitize companies in this regard.

However, this ETF is the largest position in my portfolio will change again relatively soon.

To the index

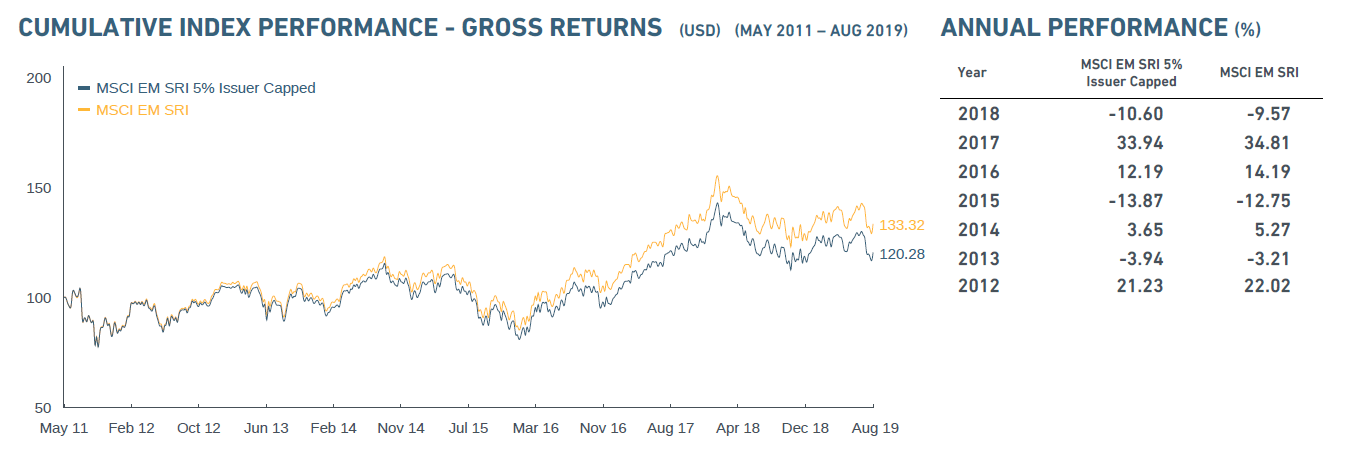

I chose the MSCI Emerging Markets SRI 5% Capped Index according to my usual criteria. I have already discussed the MSCI SRI indices in more detail here.

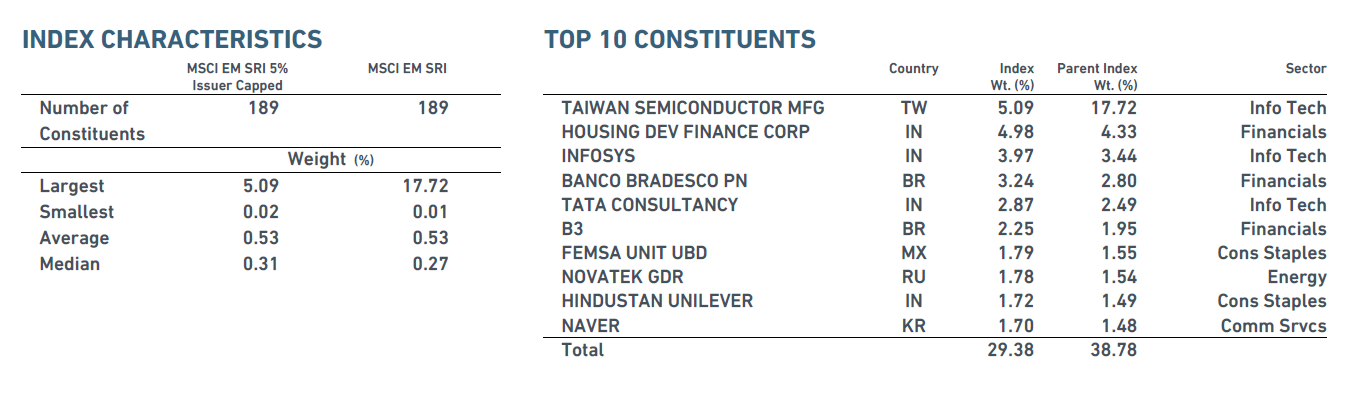

This consists of the best rated 189 individual values according to SRI/ESG criteria from the MSCI Emerging Markets universe, which covers 26 countries. The maximum weight of a company is capped at 5%.

The chart history compared to the "normal" MSCI Emerging Markets SRI. Compared to the MSCI Emerging Markets, however, the sustainable index is leading by almost 30% over the same period.

The number of companies and the TOP holdings in the MSCI Emerging Markets SRI 5%. The MSCI Emerging Markets consists of almost 1200 values.

Go to the ETF

On this index there was exactly one ETF that is both physically replicated and distributed. And that is the:

UBS ETF (LU) MSCI Emerging Markets Socially Responsible UCITS ETF (USD) A-dis (ISIN: LU1048313891)

The selection was therefore not difficult.

So on 24.09.2019 I purchased 34 pieces a 11,832 for the total price including cost of 412.29 €.

Current custody positions in the Charity Depot

| Name | Isin | Piece | Price value | Purchase value | +/- |

|---|---|---|---|---|---|

| UBS MSCI World Socially Responsible UCITS | LU0629459743 | 3 | €267.69 | +10.69% | |

| BNP Paribas Easy MSCI Europe SRI UCITS ETF | LU1753045415 | 17 | €356.56 | €348.08 | +2.44% |

| UBS MSCI Emerging Markets SRI 5% Capped | LU1048313891 | 34 | €402.29 | €402.29 | -0,00% |

The clearing account currently contains €4.53

The depot now has a value of approx. €1026.

What happens next?

Since it was already necessary to make a donation last time, I am really happy to have already brought the depot to a four-digit value this year.

I hope to counter the cliché of the greedy stock market speculator with this combination of hobby and by the way also doing good 😉

An overview of the latest transactions, the account balance and the contents of the depot and further information about the experiment can be found at any time via this page.

I try to update them once a month. Otherwise it is time to wait and drink tea.

From time to time I will post an update on the development of the depot. A next purchase is considered again from 250€ in the clearing account. Maybe I'll look around for equity or green bonds.

What do you think of the idea? Let me have a brief comment.

You want to support the Charity Depot ? Click on the advertisement you are interested in or open a depot via my site. Thank you!

[the_ad id=”1996″]